| ............. |

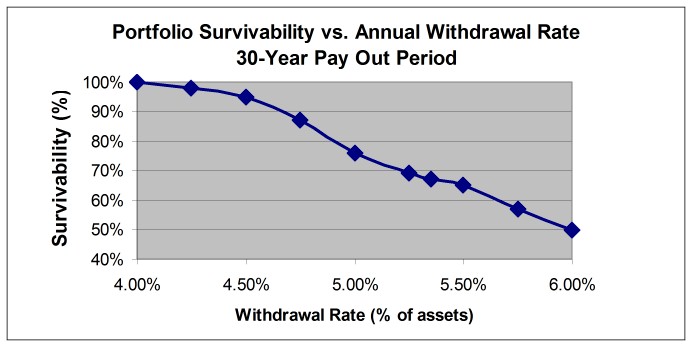

Back in July, the New York Times had a story about a pair of Charlotte, NC financial planners who were running a "boot camp" for clients who were close to retirement. For an annual fee that averaged 1.35% of the value of your retirement assets, these two ladies would guide you through a thorough cash-flow analysis, prepare a net worth statement, review your insurance coverage, and assist with tax and estate planning. They'd even help you set goals for your retirement. (Mine was to be able sleep late and watch a lot of TV.) Of course, the first thing you should be learning in a retirement "boot camp" is that it's crazy to be paying a 1.35% fee to a financial advisor. There's a broad body of research that suggests a retiree should limit his or her initial annual portfolio withdrawal to somewhere around 4% of assets. That's $40,000/yr from a $1 million account. Paying a financial advisor a 1.35% fee, or $13,500, would leave you with only $26,500 to live on. If you decided to still take $40,000 for yourself plus an additional $13,500 for your advisor, that $53,500 annual withdrawal greatly increases the risk you'll run out of money in less than 30 years. While a 4% inflation-adjusted withdrawal from a 60% stock/40% fixed income portfolio would have survived every 30-year payout period from 1871-2002, increasing that withdrawal to 5.35% would have depleted the portfolio in less than 30-years in 43 of the 129 30-year periods examined -- carrying a financial advisor would leave you broke one-third of the time.  If you still wanted to spend $40,000/yr and pay a financial advisor $13,500, the only solution would be to work longer and save more money. You'd need to increase the size of your retirement portfolio from $1 million to $1.38 million to limit that $53,500 annual withdrawal to 4% of the portfolio value. Depending on your savings rate and investment return, that could mean working an additional 5 to 15 years just to pay your financial advisor. Who's working for who? How much should you be paying in fees? You could easily assemble a diversifed portfolio of low-cost index funds (such as the one below) for an annual fee of about 0.15% of assets. Here's a sample portfolio you can put togther using Vanguard and Bridgeway funds. The portfolio includes foreign and domestic exposure; large-cap, small-cap and micro-cap stocks as well as REITs. The fixed income portion of the portfolio is split between short-term bonds and TIPS.

The amount of money a financial advisor skims from your account has a big affect on the quality and safety of your retirement. Limiting an advisor's take improves your chances. Don't let your advisor fund his own well-upholstered retirement by shortchanging your own. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

![[Retire Early]](retire.gif)

![[Retire Early]](re_ads.jpg)

![[Retire Early]](ademail.jpg)