| ............. |

This article was first posted March 1, 2017. President Trump has promised to "repeal Obamacare" and replace it with a plan that has "lower premiums and deductibles, and everyone will be covered". That's fantastic, but all of the proposals coming out of the Republican Congress seem to feature higher costs for a crappier health plan. No wonder many leaders in Congress are getting cold feet on any changes. (See, How Republicans Might 'Repair' Obamacare Before Repealing It.) In any event, the current Obamacare is a bonanza for early retirees living off of investment income. (See, How Millionaires Get Obamacare Subsidies Intended to Aid the Poor .) You could own $100 million of Berkshire Hathaway stock and still qualify for a big tax subsidy as long as you are able to minimize your dividends and capital gains. After several years of retooling my retirement portfolio, I got my 2017 Obamacare premium down to $54/month. How much better can Trump make it?

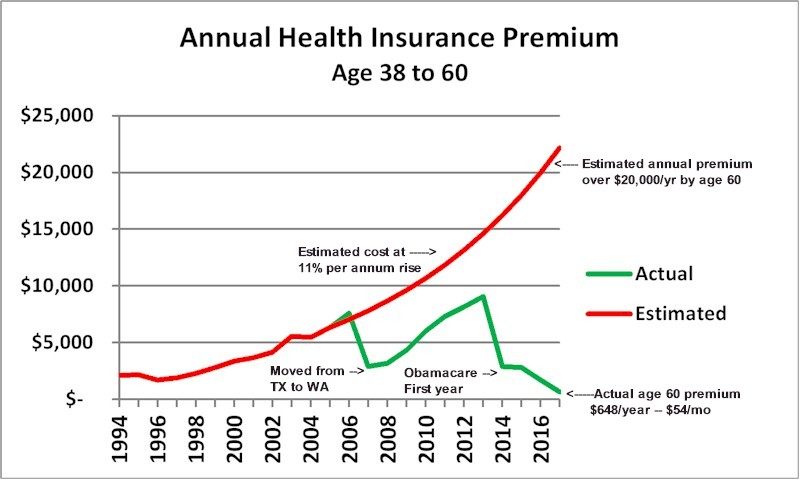

Isn't that a pretty picture? If you look at the chart above, you'll see I had roughly 11% per year premium increases in the first ten years of my retirement when I was living in Houston -- 11% per year despite the fact that I was increasing my deductibles and co-pays like everyone else and, in effect, accepting crappier coverage to control costs. Projecting that trend line out to age 60 would have left me with a $20,000/yr premium for progressively worse health insurance coverage. In 2006 I moved to Washington State and my health insurance premium decreased by over 60%. But after a few years started rising at an average 10% to 12% per year like before. When Obamacare started in 2014, I got another 60%-70% premium reduction since I'd already started minimizing dividends and capital gains to get my portfolio "Obamacare-ready". Continued vigilance was rewarded with a $54/month health premium in 2017. Never would have imagined that when I was looking at that bright red trend line in back in 2006.

Resources for additional information. Time Magazine -- Bitter Pill: Why Medical Bills Are Killing Us How Millionaires Get Obamacare Subsidies Intended to Aid the Poor, by Dan Mangan,CNBC,January 26,2016

Why I'm Not Worried About Obamacare Premium Increases, Retire Early Home Page, November 2014

CBO estimate of health insurance premiums under Obamacare, Nov. 30, 2009

Health Care Reform in Indian Country

Health Insurance Premium Credits in the Patient Protection and Affordable Care Act (ACA) Kaiser Family Foundation - Health Reform Subsidy Calculator Federal Register - Health Insurance Premium Tax Credit IRS - Affordable Care Act Tax Provisions Actuarial Value and Cost-Sharing Reductions Bulletin Plan Levels and Standardization of Coverage Commonwealth Fund -- Choosing the Best Plan under Obamacare |

![[Retire Early]](ademail.jpg)